After three years of significant correction, the North American secondary market for Audemars Piguet watches appears to have found its footing in 2025. For those of us who’ve watched this space closely, the numbers tell a story of market maturation that’s worth examining in detail.

The Correction in Context

The Royal Oak “Jumbo” (15202ST) serves as our bellwether. After peaking above $150,000 in early 2022, it traded around $90,000 in 2023, dropped to $60,000 in 2024, and now sits near $55,000 in mid-2025. That’s a 65% decline from peak – dramatic, but perhaps inevitable given the speculative premiums that had accumulated.

More telling is how this affects the broader Royal Oak lineup. The 41mm time-only reference (15500ST) has stabilized around $36,000 after dropping from $40,000+ in 2023. Even more importantly, we’re seeing the first signs of modest recovery – that same reference gained 3% from 2024 to 2025.

Model-by-Model Performance

The data reveals clear patterns across AP’s collections:

Royal Oak Core Models: Still commanding premiums over retail, but far more reasonable ones. Most variants now trade 10-50% above MSRP rather than the 200-300% premiums we saw at peak.

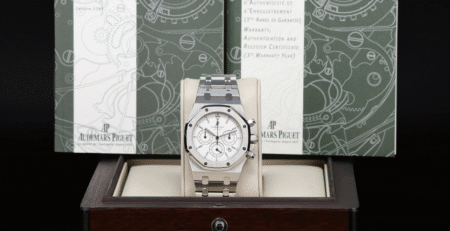

Royal Oak Offshore: This segment tells a different story. Many chronograph variants have fallen below retail prices, with the 42mm steel chrono (26470ST) dropping from $25,000 in 2023 to around $18,000 today. The supply-demand dynamics here favor buyers significantly.

Code 11.59: Perhaps the most interesting development. After years of trading below retail, we’re seeing genuine recovery. The chronograph variant gained 14% in 2025, suggesting the collection is finally finding its audience.

What the Numbers Mean

Stripping away market noise, several factors emerge:

The convergence toward retail pricing indicates healthier market fundamentals. When secondary premiums shrink, it typically signals that speculative demand has been wrung out, leaving genuine collector interest as the primary driver.

Regional data from North America shows wait times at authorized dealers have decreased for many references – another sign of normalization. The frenzy that made even basic Royal Oak variants “unobtainable” has clearly subsided.

Auction results provide additional context. While current-production pieces have corrected, vintage Royal Oaks continue performing strongly. A 1972 A-series sold for $57,150 at Phillips in December 2024, well above the estimate.

Market Mechanics Going Forward

Three dynamics seem to be shaping the current environment:

Supply Reality: AP’s annual production remains constrained at roughly 50,000 pieces. This fundamental hasn’t changed, but buyer behavior has normalized significantly.

Demographic Shifts: Data suggests younger collectors are increasingly looking beyond Royal Oak variants, which may explain Code 11.59’s improving performance and could influence long-term demand patterns.

Global Context: AP’s Q1 2025 performance (+0.8%) outpaced the broader luxury watch market (-3%), indicating relative strength even in a correcting environment.

The Collector’s Perspective

For serious collectors, current market conditions present opportunities not seen since pre-2020. Many references that were effectively off-limits due to pricing are now accessible at more rational levels.

The key insight isn’t about timing markets – it’s about fundamental value. AP’s position within the trinity remains secure, manufacturing quality hasn’t diminished, and brand equity appears intact despite price volatility.

What we’re witnessing isn’t brand deterioration but market maturation. The secondary market is pricing in genuine collecting interest rather than speculative demand, which ultimately benefits long-term enthusiasts.

Looking Ahead

Based on current trajectory and historical patterns, modest price appreciation aligned with retail increases seems most likely going forward. The exponential growth of 2020-2022 was unsustainable, but AP’s fundamental appeal to collectors remains strong.

For those tracking these markets professionally, the stabilization we’re seeing in 2025 suggests we may have reached a new equilibrium. Whether this proves durable will depend largely on broader economic conditions and luxury spending patterns, but the underlying collector base appears solid.

The data suggests we’re in the early stages of a normalized market where collecting decisions can be made based on personal preference and long-term appreciation rather than fear of missing out on speculative gains.

Analysis based on transaction data from Chrono24, WatchCharts indices, and auction results from major houses through mid-2025. All figures represent approximate market averages and individual transactions may vary significantly based on condition, provenance, and specific variants.