Beyond brand recognition, long-term value in timepieces is shaped by several interdependent factors:

Rarity & Limited Production – Scarcity often fuels appreciation. Discontinued references and low-production runs tend to outperform mass-market models over time.

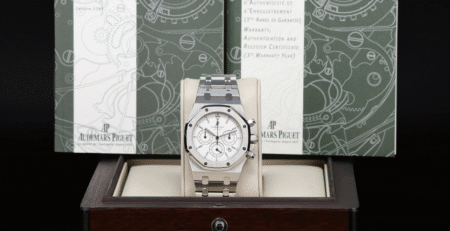

Condition & Provenance – A full set (box, papers, original components) significantly enhances liquidity and resale value. Verified service history and documentation reinforce buyer confidence.

Market Trends & Demand – A generational shift is underway. As Gen Z and millennial collectors enter the space, cultural influence and aesthetic preferences are reshaping what’s considered desirable.

Take Hublot, whose bold design language often misunderstood by traditionalists, but increasingly favored by younger collectors for its disruptive design and bold material experimentation. From carbon fiber and ceramic to sapphire and titanium blends, Hublot’s Big Bang series has carved out a niche where avant-garde aesthetics meet genuine mechanical intrigue. Its limited-run collaborations and scarcity models continue to gain attention as modern collectible assets.

Heritage & Technical Innovation – Timelines matter. Omega’s co-axial escapement, Patek Philippe’s perpetual calendars, and Richard Mille’s material science continue to drive sustained interest and future-proof their place in top-tier collections.

Related Posts

How to Identify Luxury Watches That Will Hold Their Value: The Ultimate Investment Guide

Did you know most luxury watches lose 20–50% of their value immediately after purchase, but a handful of iconic models... read more

Luxury Watch Market Outlook: 2025–2030

The global luxury watch market is projected to grow from $54.31B in 2025 to $72.13B by 2030. But here’s the... read more

How to Spot Fake Luxury Watches? The Definitive Guide to Counterfeit Watch Detection in 2025

What Are Super Clone Watches? Understanding the Evolution of Fake Luxury Timepiece.

The counterfeiting of timepieces traces back to the early... read more

AP Prices in 2025. Are We Finally Back to Reality?

After three years of significant correction, the North American secondary market for Audemars Piguet watches appears to have found its... read more

Family Heirlooms vs. Investment Pieces. Finding the Balance in Watch Collecting.

The North American watch market in 2025 tells a complex story. Following a 2.8% decline in 2024, the market showed... read more

Dollar’s Decline: What It Means for Luxury Watch Collectors

After analyzing trends across our inventory and consulting with industry partners, I wanted to share my perspective on what this... read more

Where has this watch been?

In high-stakes collecting, that single question can add or erase thousands of dollars. Provenance is the paper trail and physical... read more

Timing the Pre-Owned Watch Market

The pre-owned luxury watch market has evolved from shadowy dealer networks to a $24.38 billion global industry. While growth projections... read more

28% Tax on Your Rolex? How to Keep the Other 72% in 2025

The Illusion of Gross Profit

Michael, an investment banker in New York, proudly sold his Rolex Submariner for $38,000 after purchasing... read more

Watches as Strategic Investments

For collectors and investors alike, luxury watches hold a special place.They represent craftsmanship, heritage, and, for some collectors, an alternative... read more